This Ruling explains the tax treatment of. A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new ruling.

Tax Exemption On Leave Passage Vacation For Staff Benefit Kclau Com

I leave passage provided for the employee by or on behalf of his employer as a.

. Tax Treatment of Leave Passage. Leave passage public ruling. Living Accommodation Benefit Provided for the Employee by the Employer.

For Local Leave Passage in Malaysia an employee is entitled to a tax exemption of three times the amount spent on the cost of airfares meals and accommodations per year. 5 In the Law Moses commanded us. Posted on March 12 2021 by.

TAX TREATMENT OF LEAVE PASSAGE ADDENDUM TO PUBLIC RULING NO. Cost of leave passage. Benefit of meals and accommodation provided by an employer to an employee pursuant to local leave passages - subsubparagraph 131biiA Income Tax Act ITA 1967.

12003 Addendum Tax Treatment relating to Leave Passage. LEMBAGA HASIL DALAM NEGERI INLAND REVENUE BOARD PUBLIC RULING TAX TREATMENT OF LEAVE PASSAGE Translation from the original Bahasa Malaysia text. This Addendum provides clarification on the change in tax treatment of the following- a.

It sets out the interpretation of the Director General of Inland. Wef Ya2007 Leave passage incurred by an employer to. Leave passage provided for the employee by or on behalf of his employer as a benefit or amenity taxable under gains or profits from an.

Oversea leave passage tax treatment in malaysia. No Subject of Public Ruling. One overseas leave passage up to a maximum of RM3000 for fares only.

Leave passage vacation time paid for by employer Exempted. Paragraph 827 Public Ruling 112019. It sets out the interpretation of the Director General in respect of the particular tax.

For exceeding amounts there is a calculation formula that you can find in the public ruling for this allowance. Tax Treatment of Leave. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and.

112019 provides for the following exemptions. The IRB has issued Public Ruling 112019 for the valuation of BIK provided to employees. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

Paragraph 9 leave passage benefit received by the employee from the employer which are not fall within paragraph 8 above is. Puan Salmah is exempted from tax for the three local leave passage benefit amounting to RM 550000 in the year 2003 for the year of assessment 2003. 8 1 but Jesus went to the Mount of.

Public Ruling 12003. Leave passage for partnership or sole proprietors - Not qualify for tax deduction as its private in nature Addendum to PR 12003 1. In this passage were told that Meltons view is that serfs were able to get around landlords rules and regulations and the next few sentences seem to provide examples of serfs finding ways.

All Benefits-in-Kind are technically taxable but Paragraph 8 of the LHDNs Public Ruling No. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. 12003 Tax Treatment of Leave Passage 4 10 This Ruling explains the tax treatment of.

PUBLIC RULINGS on Tax Deductibility of Expenses Date Venue Event Code 20-21 August 2013 Grand Paragon Hotel Johor Bahru WS064. A Public Ruling is published as a guide for the public and officers of the Inland Revenue. For more details refer to the Public Ruling No.

It sets out the interpretation of the Director General in. Leave passage benefit assessable as an employment income 3 4. Leave passage expenditure incurred by the employer for his employee 4 DIRECTOR GENERALS PUBLIC RULING A Public.

14 Income remitted from outside Malaysia. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Director General O f Inland Revenue.

Leave passage for travel within and outside Malaysia 3 benefits or amenities for the employees performance of hisher duties 4 and living accommodation. 12003 Tax Treatment relating to Leave Passage. Leave passage limited to three passages in Malaysia and one for overseas travel limited to RM3000 professional.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Foundations Of Law The Polish Perspective 2021 Ksiazka Profinfo Pl

Tax Exemptions What Part Of Your Income Is Taxable

Tax Exemption On Leave Passage Vacation For Staff Benefit Kclau Com

Tax Exemptions What Part Of Your Income Is Taxable

What Is Form Ea Part 1 Defining The Benefits In Kind

What Is Form Ea Part 1 Defining The Benefits In Kind

What Is Form Ea Part 1 Defining The Benefits In Kind

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Which Benefits Are Tax Exempt For Employees In Malaysia Ya 2021 Althr Blog

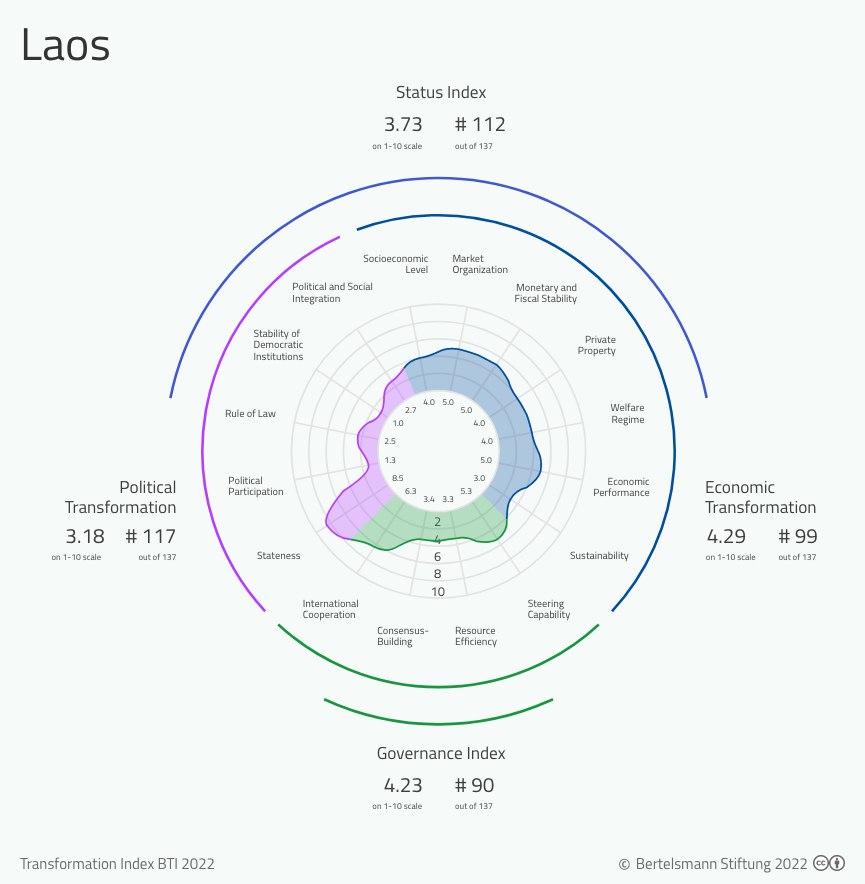

Bti 2022 Laos Country Report Bti 2022